Mint vs EveryDollar vs Personal Capital: Who Wins for Personal Finance?

I had been using Mint almost as soon as I got out of school. However, the personal budget scene has matured quite a bit in the last seven years. Mint used to really be the only game in town. Now they have competition.

For the last few months, I've been testing out three different tools: Personal Capital, Mint and EveryDollar. I haven't found a one-size-fits-all solution for everything yet and each tool brings something unique to the table. Which one is best? It depends on your personal needs.

Personal Capital: A Dashboard for Your Total Financial Health (Free)

Right out of the gate, I would say that Personal Capital does one thing really well - show you your overall performance in terms of personal finance. This isn't a great tool for an entry-level grad who is just starting to learn how to make a budget. It's more geared to people who have started some retirement savings and have other things to track like a mortgage or car values.

While Mint offers the ability to sync your various bank accounts, Personal Capital is the only one that I found that does it relatively error-free. It would match up to accounts that Mint wouldn't sync with and did a great job of displaying a great visual representation of how things were trending.

What Personal Capital doesn't do all that well is actual day-to-day budgeting. It offers that capability but it's obvious that wasn't what the platform was built for.

My biggest complaint were the sales calls. Mint may bombard you with ads but Personal Capital reps would call my phone asking me (multiple times) if I wanted to use them for investment services. I wasn't interested and still received calls after I deactivated my account.

The lack of focus on day-to-day budgeting was the biggest reason I ended up discontinuing my account. If I end up needing to track more retirement savings down the road and still feel comfortable having one source connect to my entire financial life, I may rejoin down the road. It's just not the tool for me right now.

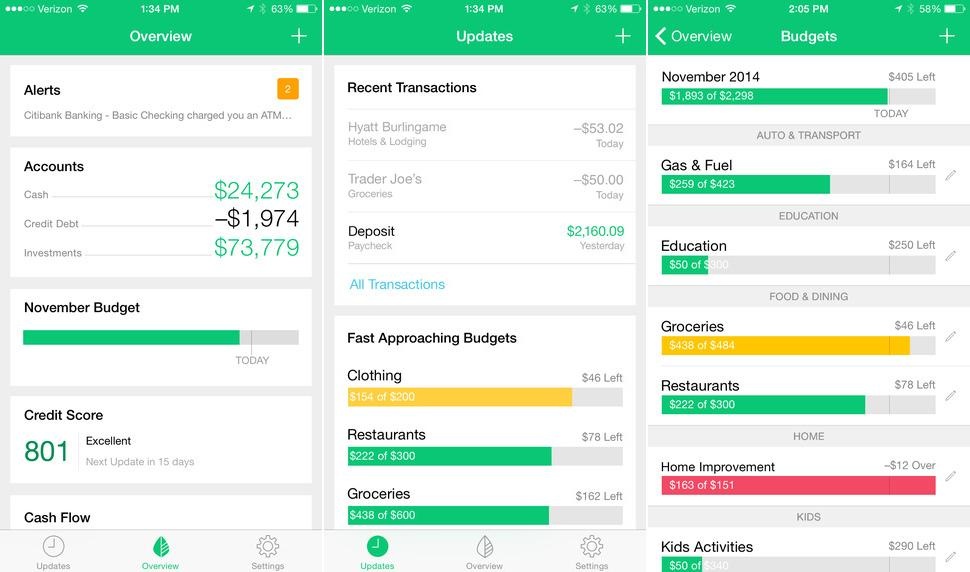

Mint: The Old Standby (Free)

Mint does do personal budgeting very well. And it's free. I've been using it for years and still like it. For the most part anyway.

One of the things I love are the historical trends they provide. Budgeting can be pretty hard, especially when it comes to projecting monthly spends on things like gas and utilities. Being able to look back at previous years has been a fantastic resource for budgeting well on various months.

I also like the ability to automatically categorize purchases into budget items. Even though I have to go in and make adjustments from time to time, not having to write EVERY SINGLE THING down makes tracking monthly budgets a little more accurate.

Mint also offers the availability to connect your various bank and investment accounts in the same way Personal Capital does. However, just because they offer it doesn't mean it always works. They discontinued their availability for tracking our house mortgage out of nowhere and then lost connection with our main spending account this week - which left me in a bit of a lurch for remembering where we were in certain budget items for end-of-the-month spending, making me have to guess.

If everything worked exactly as advertised, Mint would be great. It'd probably be my favorite. However, the random bugs and connectivity issues it seems to almost always have (in addition to the bombardment of credit score ads) can be off-putting for many. While I like it and still use it, I'm not a completely happy customer.

EveryDollar: The Easiest Household Budgeting Tool (Free)

If you are looking at something that is great at tracking your household budget month-to-month, EveryDollar is hands-down the fastest tool to do so. It's created by the Dave Ramsey team and forces users to plan a zero-based budget like what is taught in Financial Peace University classes.

They advertise that you can setup a budget in less than 15 minutes - and they're right. It took little effort to setup the budget items and took way less time to do than in any other tool I've used. It's simple and both the desktop and mobile app experience are extremely minimalistic. There aren't a lot of bells and whistles. It just helps track spending. Period.

Where it does well in setting up a budget, it's very manual for tracking spending. Unless you upgrade to their $99/year premium version, there's no bank connectivity. Every purchase has to be tracked manually. If you're out shopping, inputting an expense in the moment via the app is easy. However, if you are dividing and conquering with a spouse on shopping, it makes spending a little harder to track. You have to go back and look at online statements to make sure everything is up-to-date.

Although, there is something to be said for having to write down every expenditure to really see where your money is going.

Which one do I prefer?

When everything works, Mint. I love the budgeting, the automatic spend tracking and trend reports. If all of the bank accounts synced up as advertised, it'd be my personal finance weapon of choice.

However, EveryDollar has Mint beat in terms of simplicity. There's something to be said for only trying to do one thing well instead of many.

At the moment, it's EveryDollar for me. Primarily because, at the time of writing this post, my Mint won't connect to my spending account, which effectively renders it useless.

How about some of you? What have you used? What do you like/dislike?